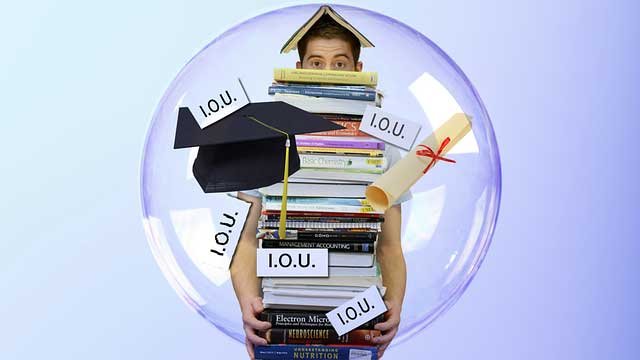

In an effort to compete within the economic system of tomorrow, many younger Individuals might want to earn a complicated diploma — round 65 % of all jobs in the US would require some post-secondary training by 2020. However wages haven’t grown considerably over the previous a number of years, and scholar debt holders are being pinched.The end result: Greater than 30 % of scholar mortgage debtors are in default, late or have stopped making funds after simply six years.

CNBC cites reviews that inside six years, greater than 15% of scholar debtors had formally defaulted, whereas 10% extra had stopped making funds and one other 4.8% had been a minimum of 90 days late. And for-profit schools fared even worse, the place practically 25% of graduates defaulted, and a complete of 44% confronted “some type of mortgage misery.”

These tendencies had been masked by Division of Training reviews which stopped monitoring compensation charges after simply three years (reporting defaults charges of simply 10%), in line with Ben Miller, senior director for post-secondary training on the left-leaning Heart for American Progress. “Official statistics current a comparatively rosy image of scholar debt. However outcomes over extra time and in higher element reveals that lots of of hundreds extra debtors from every cohort face troubles repaying.”

30% after america’s can’t debt: debtors hold management mortgage scholar six years